Who we are

The Rio Grande Valley Multibank (RGVMB) is a Community Development Financial Institution (CDFI) currently working in the Lower Rio Grande Valley of Texas, bordered by Mexico to the south and the Gulf of Mexico to the east. The RGVMB is a for-profit stockholder held organization owned by twelve (12) banks and organizations; Wells Fargo, Bank of America, BBVA, Frost Bank, International Bank of Commerce– Brownsville, IBC– McAllen, IBC– Zapata, National Cooperative Bank, Lone Star National Bank, Falcon Bank, cdcb-come dream. come build, and the Cameron County Housing Finance Corp. The RGVMB's current target market is the Lower Rio Grande Valley, Texas (RGV). The RGV is one of the poorest and fastest growing regions in the United States. The RGVMB's target population is the growing, low-to-moderate income Latino population.

In 1996, the RGVMB received certification as a Community Development Financial Institution from the United States Department of Treasury. The Corporation’s most recent recertification was received in 2020. The RGVMB became the first CDFI to become a member of the Federal Home Loan Bank of Dallas in 2013.

Since its founding in 1996 the RGVMB has assisted 63,820 families and lent over $108 million. Community impacts to date include:

· Over 700 Mortgage loans totaling over $45.5 million dollars all to families earning less than 80% AMFI.

· Over 27,500 Small Dollar Loans made to individuals in the Rio Grande Valley, over $25 million in total loans originated, with only a 3.85% loan loss in 2019.

· Franchised thirteen (13) approved Community Loan Centers with local non-profits in six (6) states since 2014, lending an additional $32.8 million to 34,000 families.

· Interim construction financing totaling $4.5 million developing over 350 new single-family homes all for families earning less than 80% AMFI

· Acquisition financing of raw land and improved lots totaling $852,000 for the purchase by local affordable housing non-profits upon which 242 new affordable homes have been built and sold to families earning less than 80% AMFI.

Since its inception, the RGVMB has been managed on a day-to-day basis through an Administrative Agreement with the CDC of Brownsville which provides staffing, technical, administrative, accounting and expanded development services to the RGVMB. This arrangement has served to maximize efficiencies, reduce costs and provides for shared staffing.

Board Members

- Lee Reed - International Bank of Commerce

- Robert Lawrence - Wells Fargo

- Juan Loya - PNC Bank

- Sergio Gonzalez - Lone Star National Bank

- Rocio Lucio - Frost Bank

- Fernando De La Cerda - International Bank of Commerce

- Claudia Cantu-Grimaldo - cdcb

- Olga Gonzalez- Falcon Bank

- Vacant - Cameron County Housing Finance Corp.

- Wendy Hanson - United Way (Community Member)

- Vacant - (Community Member)

- Vacant - (Community Member)

RGVMB Staff

- Nick Mitchell-Bennett - Administrator

- Edna Oceguera - Deputy Administrator

- Nadia Erosa - Operations Manager

- Kristine Saldana - Executive Assistant

- Linda Marin - Mortgage Loan Underwriting

- Marcela Saenz - Communications & Marketing

- Rose Jaramillo - CLC Business Relations

- Maria Olevarez - CLC Loan Servicing

- Felisha Rodriguez - CLC Loan Servicing

- Yezzenia Garza - CLC Loan Servicing

- Judith Martinez-Marques - CLC Loan Servicing

- Juanita Garza - Mortgage Loan Servicing

Financial Position

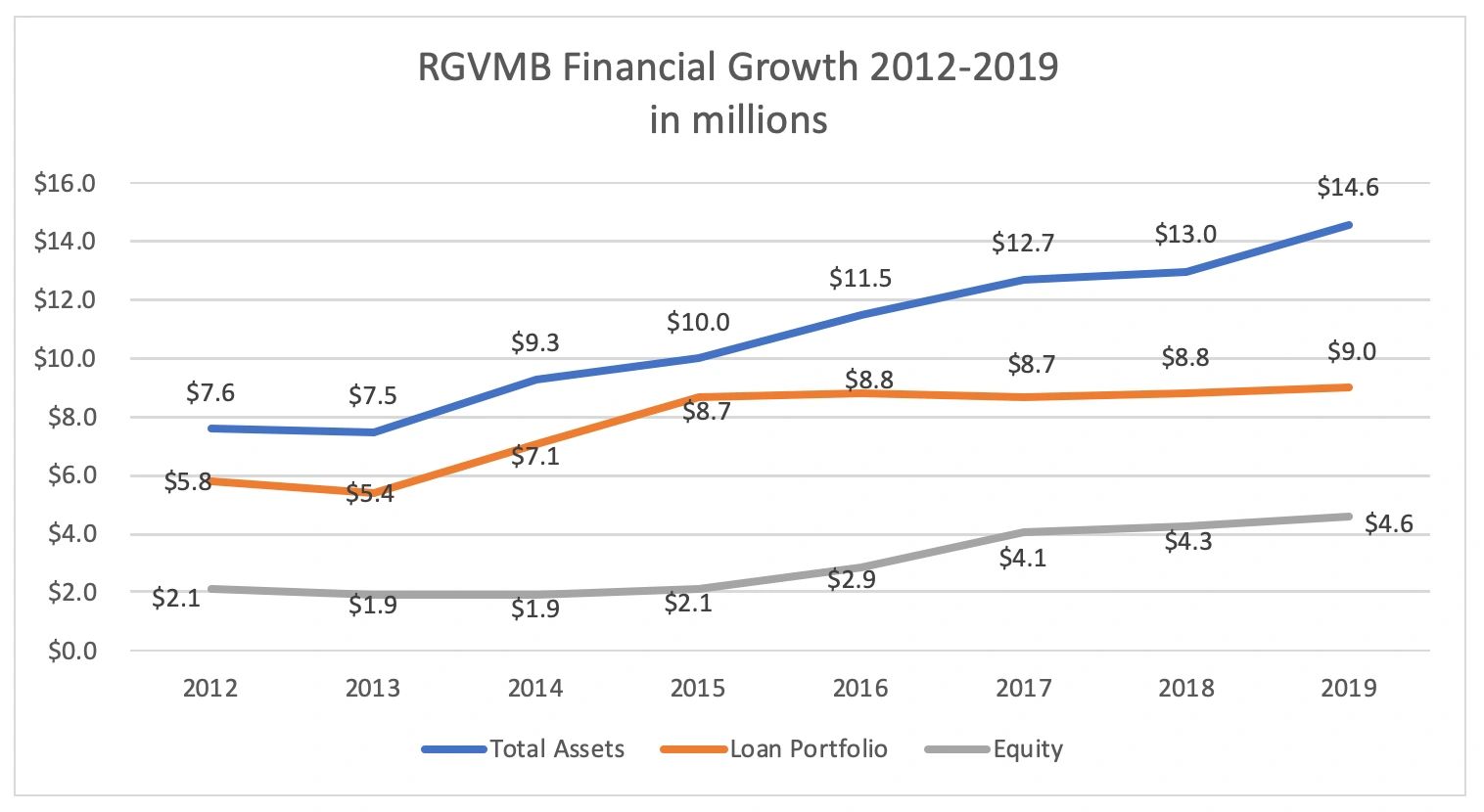

Financial Growth 2012-2019

In 2009 the Rio Grande Valley Multibank had a hard decision to make, do we close our doors or do we expand into the market place with new and lofty goals to truly impact the Rio Grande Valley. We decided that the second option was the way to move. At that time the real estate market and national and local economies were at their lowest point, nevertheless, we saw opportunity where we could make a difference in people’s lives and make the RGVMB successful.

In 2012 our total assets were just $7.6 million, equity stood at $2 million and mortgage loan portfolio was at $5.8 million and shrinking. In order to increase our financial strength, we set out to do two things that no other CDFI had yet perfected; join the Federal Home Loan Bank of Dallas and create a small dollar loan program to compete against high cost payday lenders in the RGV. Using these two strategies we grew Total Assets from $7.6M in 2012 to $14.6M by December, 2019. Grew the loan portfolio to $9 million and more than doubled equity to $4.6 million.

The RGV Multibank Strategic Plan

In early winter 2017, RGVMB staff and board met to start its three-year strategic planning process with an idea session. At this session, staff and board reviewed the past three year’s history as well as looking at internal and external challenges and opportunities. In April 2017 RGVMB invited more than 30 people (board, staff, franchise network members and friends) to a two-day strategic planning event at the Federal Reserve Bank of Dallas moderated by Joe Gonzales of NeighborWorks America. The main question of the session to be answered was “How do we get to 50,000 loans a year?”

CASA Loan Originations

CASA Loan History

CASALoan (formerly known as Affordable Housing Loan Program)

The RGVMB's oldest affordable mortgage financing program is the Affordable Housing Loan (AHLP) program, now rebranded as the CASALoan Program. Since its founding in 1994, over 700 loans totaling over $45.5 million dollars in first lien loans have been made all to families earning less than 80% AMFI. This includes a six-year period, starting in 2006, when the loan product was dormant after it was overwhelmed by rampant no down, no doc, no income lending products in the area and the subsequent housing crisis in 2009. The RGVMB discontinued the product due to lack of interest by clients.

The product remained dormant until 2013 when the AHLP was rebranded as the CASALoan and the RGVMB began utilizing its new line of credit with the Federal Home Loan Bank of Dallas. Since the relaunch of the CASALoan in 2011 the RGVMB has originated over 134 CASALoans totaling $8.2 million.

Community Loan Center Small Dollar Loans in the RGV

Communty Loan Center in The Rio Grande Valley

Small Dollar Loan Program- Community Loan Center (CLC)

The RGVMB newest program is its Community Loan Center’s small dollar loan program. This product was created to provide a marketplace alternative to high cost payday, pawnshop, signature loan, car title loan, and check cashing outlets. The RGVMB has been operating this program over the past eight years and has to date originated over 28,000 transactions in the Rio Grande Valley totaling over $25 million.

The program is designed to assist working families who would be currently utilizing the services of a high cost payday or salary advance lender to meet their needs. The amortization term and monthly payment amount is calculated to allow the family sufficient time to repay (versus having to do a rollover loan with a payday lender based on an 18-day turn), while at the same time making the monthly payments affordable based on the income of the borrower.

The CLC Loan is a maximum of $1,000, with an amortization period of 12 months, at an interest rate of 18%. A one-time $20.00 set up fee per borrower is required, altogether this equals 22% APR. Current market high cost lenders have an average effective 600% interest rate.

The RGVMB is partnering with area employers to allow them to offer the program to their employees, coordinate and assist in taking loan applications and using payroll deductions to insure repayment through the employee's paycheck. The CLC is an on-line loan origination and servicing program. This allows for less “touch” per-loan and lower expenses overall. RGVMB is able to pass these savings on to the borrower. All transactions are done on-line including application and servicing.

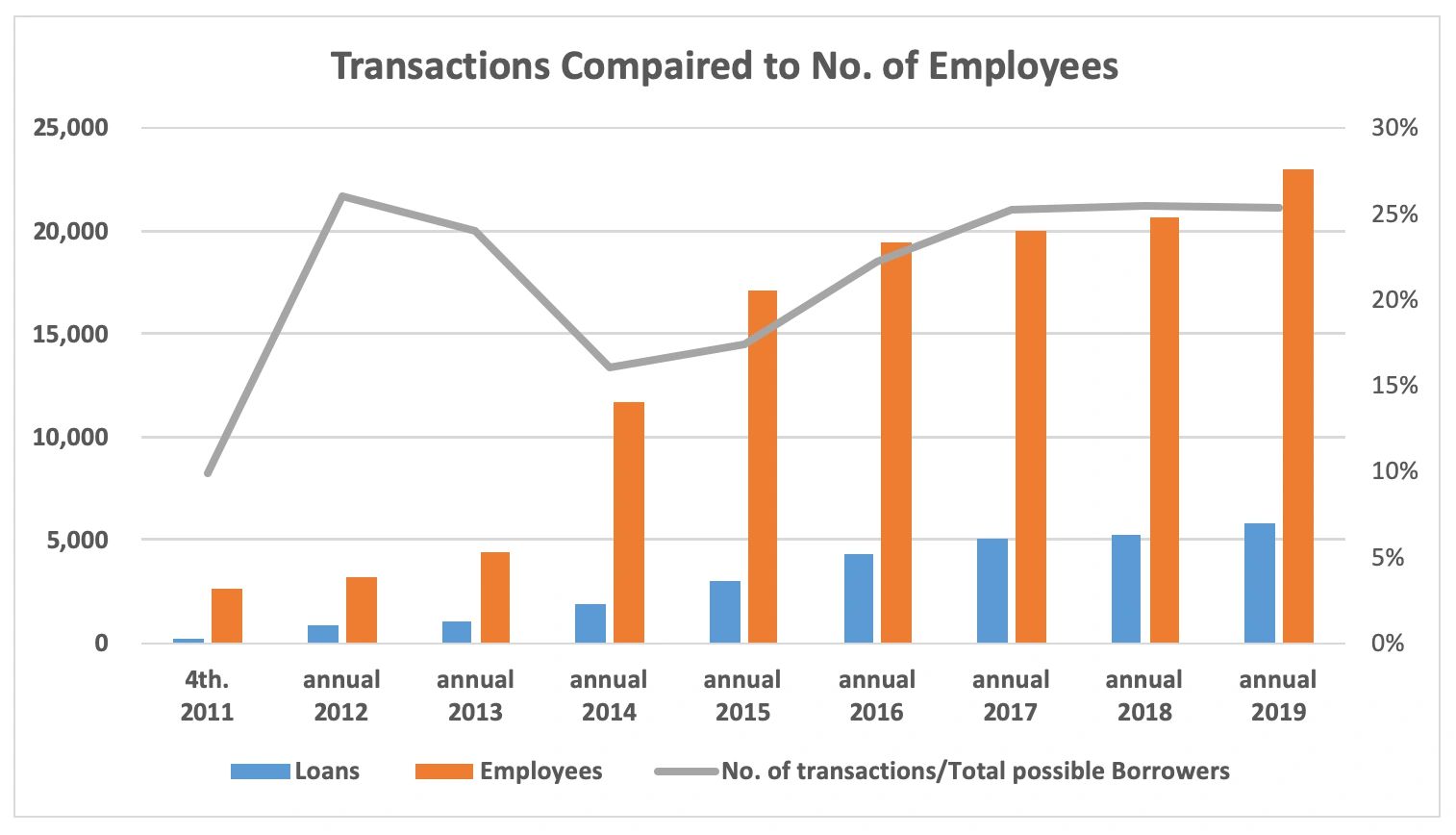

The RGVMB/CLC’s rapid growth over the past eight years is also evidence of the high demand for a low-cost alternative to payday lenders. RGVMB/CLC’s product is an employer-based program. Employers sign an MOU with the RGVMB that allows their employees to participate in the program. During the first eight years of activity the RGVMB signed MOU’s with 123 active employers with a total employee base of 23,000 people (eligible borrowers). During these eight years, October, 2011 to December, 2019, RGVMB originated 27,552 loans (208 per month); this is a market penetration of 22% annually.

Community Loan Center National Network

Community Loan Center Franchise Lenders

Community Loan Center – Franchise Services

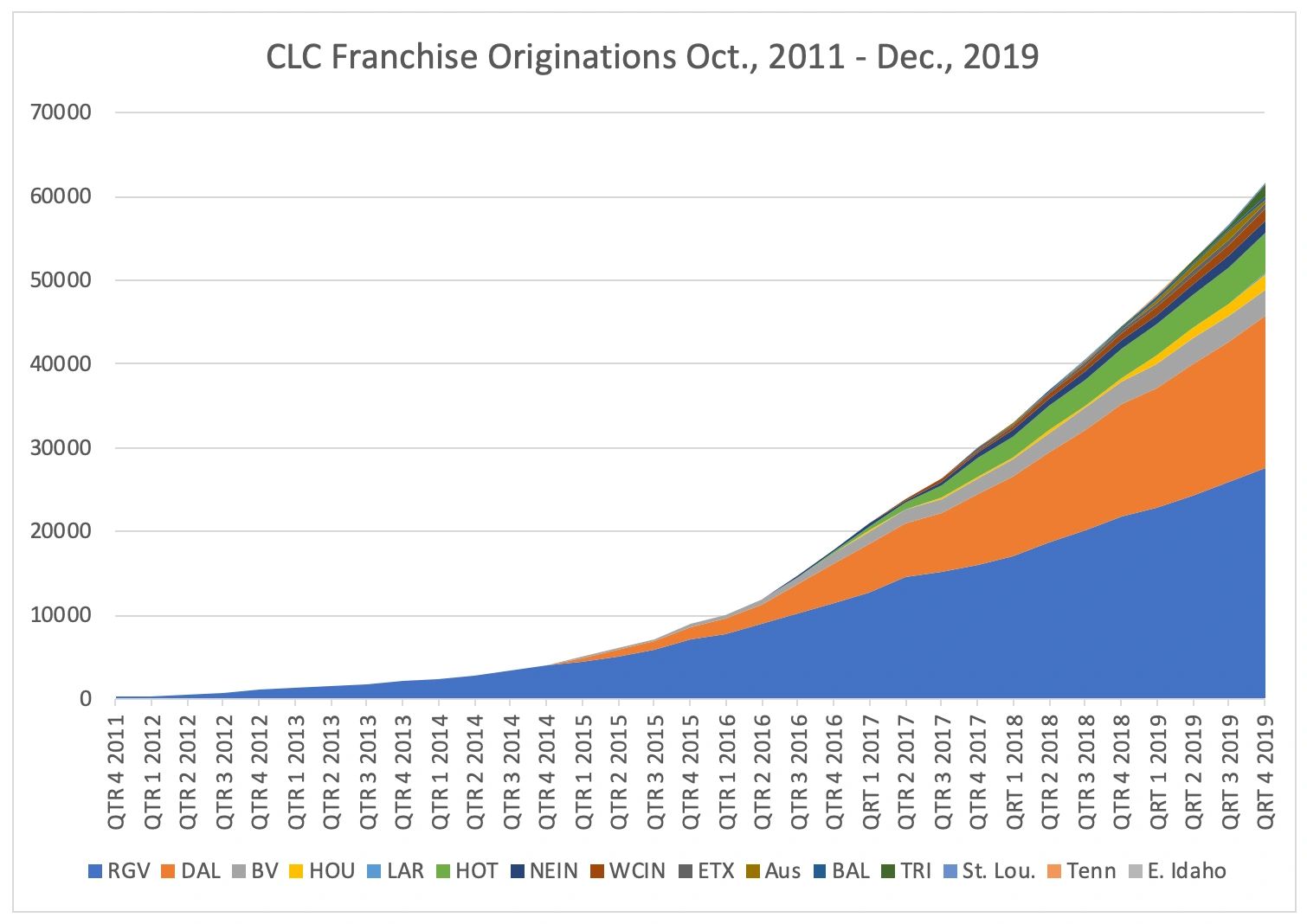

In 2014 the RGVMB began to franchise the Community Loan Center to other CDFI’s around the country. Currently there are thirteen (13) active franchises in Texas, Maryland, Indiana, Missouri, North Carolina, and Tennessee and additional two (2) more coming on line in early 2020. Since 2014 the CLC Franchises outside the Rio Grande Valley have originated over 34,000 loans totaling over $32.8 million.

Working as the Franchisor of the Community Loan Center business model. The RGVMB/CLC provides loan funding, servicing and franchise services. This bifurcated model allows local non-profit and CDFI lenders to offer an alternative to high cost loans in their market lending their own capital within a proven model. Each local lender is required to raise its own lending capital and recruit local employers and leave all the back-room administration and servicing duties to the RGVMB/CLC. This model has proven to be highly effective and has allowed the RGVMB/CLC to generate 40% of its revenue from administration and servicing fees as well as allowing the local lender to reach breakeven within two years of launch.

As the Franchisor of the CLC the RGVMB also assists local CLC franchises with start up or expansion lending capital. To date the RGVMB has made available and lent $1 million to local franchises.

press

.

Rio Grande Valley Multibank and FHLB Dallas Award $24K Grant to Texas Community Capital

Rio Grande Valley Multibank and FHLB Dallas Award $24K Grant to Texas Community Capital

.

Rio Grande Valley Multibank and FHLB Dallas Award $24K Grant to Texas Community Capital

Rio Grande Valley Multibank and FHLB Dallas Award $24K Grant to Texas Community Capital

Rio Grande Valley Multibank and FHLB Dallas Award $24K Grant to Texas Community Capital

.

Rio Grande Valley Multibank and FHLB Dallas Award $24K Grant to Texas Community Capital

.

.

Copyright © 2018 RGV MultiBank - All Rights Reserved.